- October 29, 2025

- xformative

- 0

Why Most Cloud-based API Processors Can't Handle Specialized Payments

In the world of payments, speed isn’t a luxury—it’s a mandate. Industry standards demand that processors return an authorization response in under 2 seconds, with systems timing out after 15-30 seconds.

For traditional transactions, that’s achievable: validate the card, check available funds, and approve or decline.

But specialized payments operate in a different league.

Why Speed Alone Isn’t Enough

Transactions for specialized payments don’t just ask, “Is there money?” They ask:

Who is the merchant?

What is the spend type?

Which purse(s) can allow this transaction?

- If multiple purses match, what are the ordering or authorization rules?

And, specialized must still handle responses within the same 2-second window.

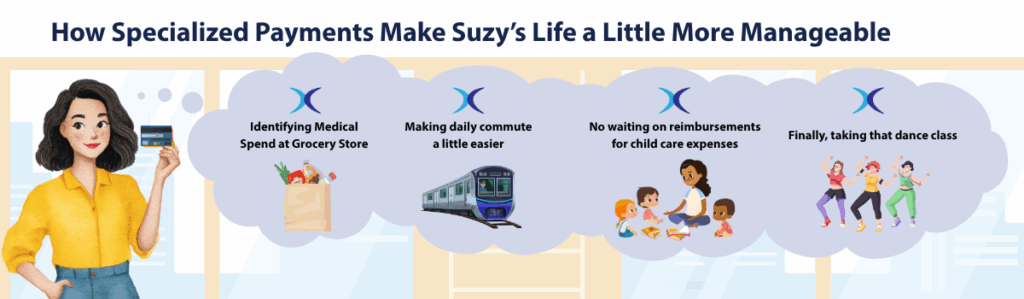

Real-world Use Case: How Specialized Payments Are Used in Benefits

Let’s use an example to demonstrate how specialized payments might work in practice. Suzy has a benefits card through her employer. Through the benefits card, Suzy has access to:

- Health Savings Account (HSA) to pay for medical expenses

- Dependent Care FSA to pay for child care / day care expenses

- Transit Account to pay for workplace commuting expenses

- Lifestyle Spending Account to pay for any wellness activity (gym memberships, fitness equipment, wellness apps, dance classes, sporting goods stores, hobby shops, etc.)

Suzy uses her benefits card everywhere she goes. First stop, the grocery store. Suzy is buying pain reliever in addition to her groceries. First, Suzy presents her benefits card. It recognizes that Suzy has $5.99 eligible for pain reliever under HSA but none of her accounts allow for spending on groceries. She is prompted for another form of payment.

Next stop, Suzy takes the train. She has loaded her benefits card to Apple Pay and taps her way onto the train. The card sees the eligible transit account and approves her spend.

On her way home, Suzy stops to pick her daughter up from day care only to discover an outstanding bill. She once again pulls out her benefits card. She has a weekly bill of $300 and only $100 available in her Dependent Card FSA. The $100 is paid from the DCFSA and prompts Suzy to provide another form of payment for the remaining amount.

One last stop for Suzy. Once a week she takes a dance class. She pulls out her benefits card and uses her LSA. At each interaction, the card is evaluating in real-time which account can be used for the specialized payments and if funds were available. In some cases, more than one account might be eligible and payment ordering rules would need to be used.

What Makes Specialized Payments Complex

Most cloud-based API processors weren’t built for this level of nuance. Their architecture is optimized for speed—but not for layered logic. Specialized payments require real-time orchestration across multiple variables, including:

Merchant eligibility and spend category validation

Purse matching and depletion sequencing

IRS or regulatory compliance checks

Multi-account rules logic (e.g., HSA + FSA + employer subsidy)

Multi-channel payment support (ACH, wire, debit-to-card, virtual wallets)

This isn’t just about speed—it’s about complexity at speed. And that’s where most processors fall short.

Legacy systems and cloud-first platforms often rely on linear logic and siloed data structures. They can’t dynamically route transactions across multiple funding rails or apply conditional rules based on merchant type, product category, or regulatory constraints. The result? Failed transactions, frustrated users, and missed opportunities for platforms trying to innovate in health, wellness, and specialized payments ecosystems.

How Xformative Solves for Speed + Complexity

Xformative’s architecture flips that script. It’s built to handle multi-purse logic, reimbursement workflows, and real-time compliance—all within the industry’s speed thresholds. In specialized payments, it’s not just about moving money. It’s about moving it intelligently.

Curious how specialized payments might work within your system? Let’s connect.