- November 12, 2025

- xformative

- 0

How to Build Out Your Funds Flow

Designing for Control, Flexibility, and Growth

In the world of consumer-directed healthcare (CDH), embedded finance, and platform-driven benefits, one concept quietly defines everything from reimbursements to real-time payments: funds flow.

For many organizations funds flow is an afterthought. Why is that? Payments platforms often dictate payments flows or place limitations on how it works. At Xformative, we believe funds flow should be visible, flexible, and designed to fit your business.

What Is Funds Flow?

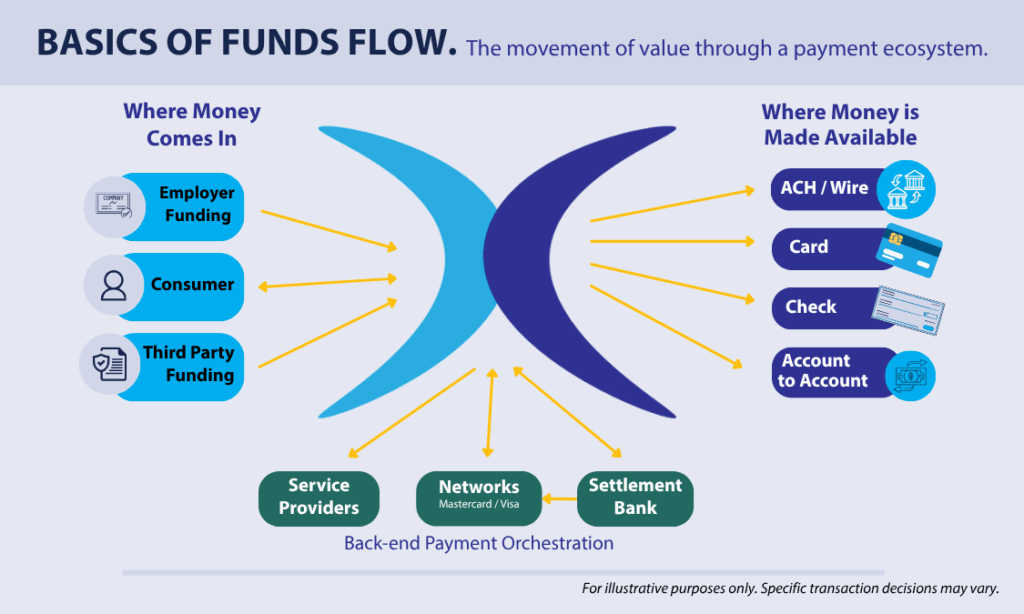

Funds flow refers to the movement of value through your ecosystem. It accounts for every possibility from the moment it enters (via funding sources like employers, individuals, or third-party payers) to the moment it’s made available for use (via cards, wallets, reimbursements, or transfers), and even reconciled across the system.

It answers questions like:

- Where does the money come from?

- How is it held, allocated, and tracked?

- When and how is it made available to the end user?

- What rules govern its movement?

- Do conversions need to occur? (i.e. Reward points to dollars, currency conversions)

- Is there a difference between available funds and collected funds? Is there a reconciliation that occurs?

Whether you’re sending CDH reimbursements, managing subsidy allocations, or leveraging embedded payment rails, your funds flow defines the logic, control, and compliance behind every transaction.

Designing Your Funds Flow

A robust funds flow starts with clarity around sources and destinations:

Where Money Comes In:

- Employer Contributions: Scheduled deposits or allocations into benefit accounts

- Individual Funding: Direct contributions and payroll deductions

- Third-Party Payments: Government subsidies, carrier contributions, etc.

- Earned Value: Apply rewards points or other value with conversion to monetary use.

- Returns or Repayments: Applying purchase returns, corrections or carrier repayments.

How Money Is Made Available:

- Card-Based Access: Real-time spend via restricted-spend cards

- Wallets and Subaccounts: Segmented funds for specific use cases

- Reimbursements: Triggered by automated feeds, manual claims, or receipts.

- Transfers and Settlements: Movement between custodial accounts or partners

Each of these flows must be auditable, configurable, and comply with applicable regulatory or plan standards (as applicable).

Why Most Platforms Fall Short

Traditional platforms often force businesses into predefined flows:

- Fixed funding sources or schedules

- Rigid account structures

- Restricted access over transaction logic

- Limited visibility into activity with custodians or processors

This creates friction, limits innovation, and makes managing plans and funding harder.

Xformative: The Processing Sweet Spot

Xformative was built to solve this. We sit at the intersection of flexibility and control, offering a processing infrastructure that lets you design your funds flow to match your business needs.

With Xformative, you get:

- Configurable Account Structures: Create subaccounts, wallets, and rules that reflect your operational logic

- Real-Time Processing: Adjust available balances instantly with full visibility and control

- Customizable Triggers: Define when and how funds are released—based on events, eligibility, timelines or user actions

Whether you’re launching a new ICHRA platform, embedding payments into a CDH app, or modernizing legacy benefits infrastructure, Xformative gives you the tools to own your funds flow.

Build for Today. Flex for Tomorrow.

Funds flow isn’t just a technical detail. It’s a competitive advantage. When designed well, it enables:

- Faster onboarding

- Better user experiences

- Easier audits

- Scalable growth

At Xformative, we help you build funds flow that handles complexity by design, enables flexibility by default, and is ready for what’s next.